Opportunities in the New State Earned Income Tax Credit

The newly created state Earned Income Tax Credit provides a modest tax credit for low income Californians – but only if they file a tax return. This session will focus on partnerships between county human services agencies and local community action agencies and how these partnerships can be leveraged to increase use of Volunteer Income Tax Assistance (VITA) and provide opportunities for subsidized employment placements and work experience. A former CalWORKs client shared her experience, community action agencies talked about their outreach efforts and services, Tehama and San Benito counties discussed their local partnerships, and the Franchise Tax Board provided information about EITC eligibility, outreach, and marketing materials.

- California Franchise Tax Board Presentation

- Community Action Agencies Presentation

- San Benito County Presentation

- Tehama County Presentation

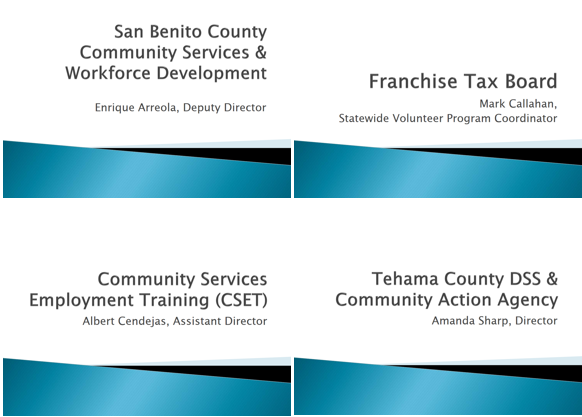

- Enrique Arreloa, Deputy Director, San Benito County Health and Human Services Agency

- Albert Cendejas, Assistant Director, Community Initiatives, Community Services Employment Training

- Samantha Ferrero, former VITA and CalWORKs recipient, Community Services Aid, Tehama County Community Action Agency

- Amanda Sharp, Director, Tehama County Department of Social Services